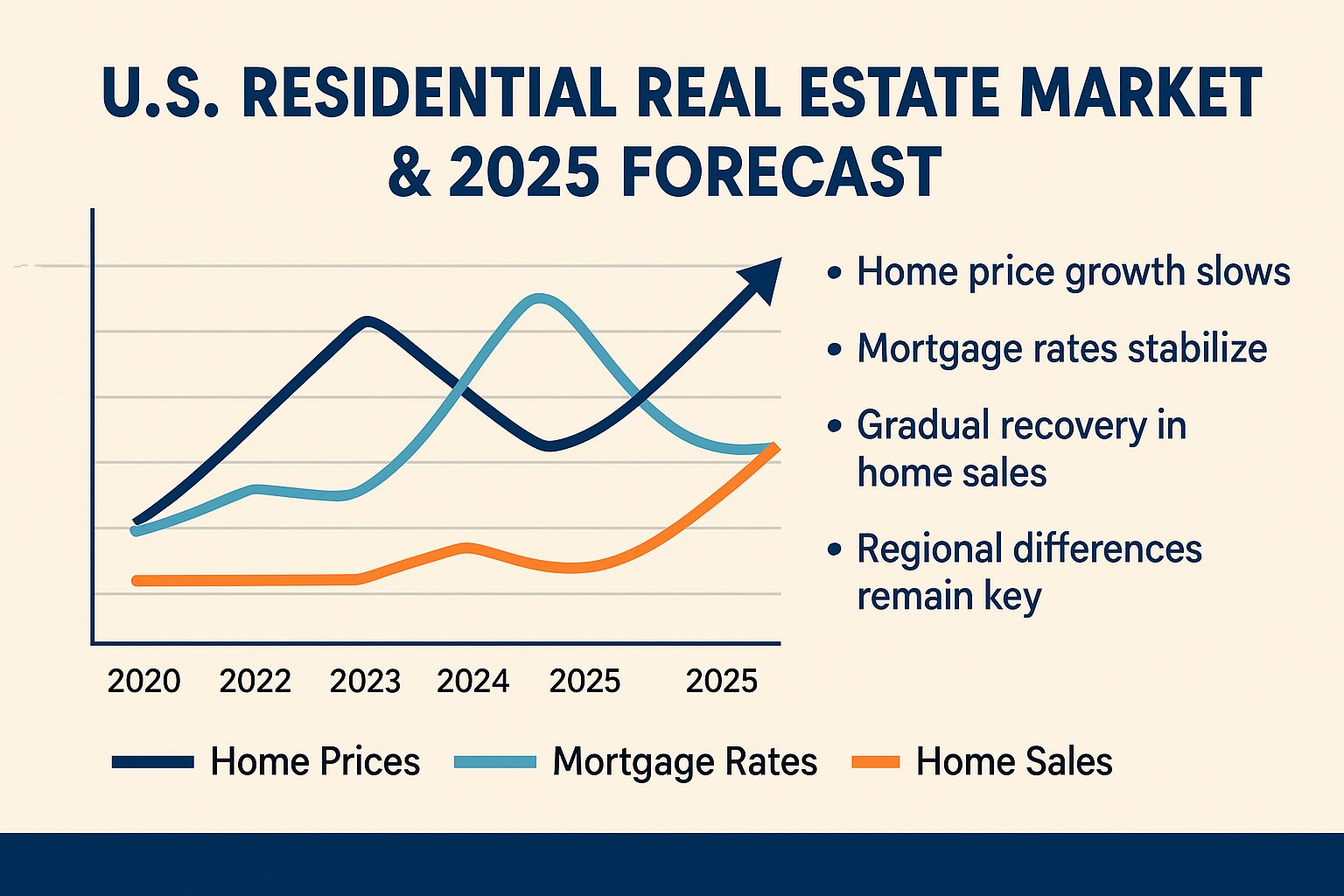

U.S. Residential Real Estate Market Trends & 2025 Forecast

The U.S. housing market has been on a rollercoaster over the past few years, influenced by fluctuating mortgage rates, limited housing inventory, and shifting economic conditions. As we move through 2025, homebuyers, sellers, and real estate professionals are seeking clarity on market trends and what the future holds.

Current Housing Market Trends (Spring 2025)

1. Home Prices Continue to Rise, But at a Slower Pace

While home prices surged in recent years, the rate of appreciation is now slowing. In 2024, home prices increased by an average of 5% year-over-year, according to the S&P CoreLogic Case-Shiller Home Price Index. However, as more homes enter the market, price growth is decelerating【23】.

2. Mortgage Rates Have Stabilized

Mortgage rates peaked at 7.79% in late 2023 but have since fallen below 6.5%. Although rates are still higher than the ultra-low levels seen in 2020-2021, they are expected to remain in the 5.5%–6.5% range throughout 2025【23】. Lower rates are encouraging more buyers to enter the market, but affordability remains a challenge.

3. Inventory Is Gradually Increasing

One of the biggest issues in the past few years has been the lack of available homes. However, as more sellers enter the market—motivated by stabilized mortgage rates and strong equity gains—housing inventory is increasing, which is helping to balance supply and demand【24】.

4. First-Time Buyers Face Tougher Challenges

Despite more inventory, first-time homebuyers continue to struggle due to high home prices and elevated borrowing costs. Many are opting for smaller homes, suburban areas, or waiting for potential price corrections before making a purchase【23】.

Market Projections for 2025 and Beyond

1. Gradual Recovery and Increased Transactions

Experts forecast that home sales will begin to rebound in 2025 as interest rates stabilize and affordability improves. The National Association of REALTORS® (NAR) projects a 10% increase in home sales compared to 2024, driven by pent-up buyer demand【22】.

2. Regional Differences Will Be Key

Not all markets will behave the same way. High-demand metros such as Austin, Nashville, and Phoenix may continue to see price growth, while previously overheated markets like San Francisco and Seattle could experience price corrections【24】.

3. New Construction Could Help Ease Supply Constraints

Homebuilders are ramping up production to meet demand. Housing starts are projected to increase by 7% in 2025, especially in affordable suburban and exurban areas【24】.

4. Mortgage Rate Cuts Could Boost Buyer Activity

If the Federal Reserve cuts interest rates as expected, mortgage rates could dip below 6% by the end of 2025. This could reignite competition among buyers and lead to a more active market【23】.

5. Remote Work Will Continue to Shape Housing Demand

With remote and hybrid work arrangements becoming permanent for many employees, homebuyers are prioritizing larger homes with dedicated office spaces, pushing demand in suburban and rural areas【22】.

Is 2025 a Good Time to Buy or Sell?

- For buyers: If mortgage rates drop and inventory continues to increase, 2025 could present better opportunities than the past two years. However, waiting too long could mean facing higher prices if demand surges.

- For sellers: Homeowners who have built significant equity may find 2025 a good time to list, especially before interest rate cuts attract more competition. However, pricing strategy will be key as buyers have more negotiating power.

Final Thoughts

The U.S. real estate market in 2025 is poised for a slow but steady recovery. While challenges like affordability and interest rates remain, increasing inventory and a stabilizing economy suggest a more balanced market. Whether you’re buying, selling, or investing, staying informed and strategic will be critical in navigating the evolving housing landscape.

Sources:

- National Association of REALTORS®: 2025 Housing Market Outlook【22】【24】

- Forbes Advisor: Housing Market Predictions 2024-2025【23】